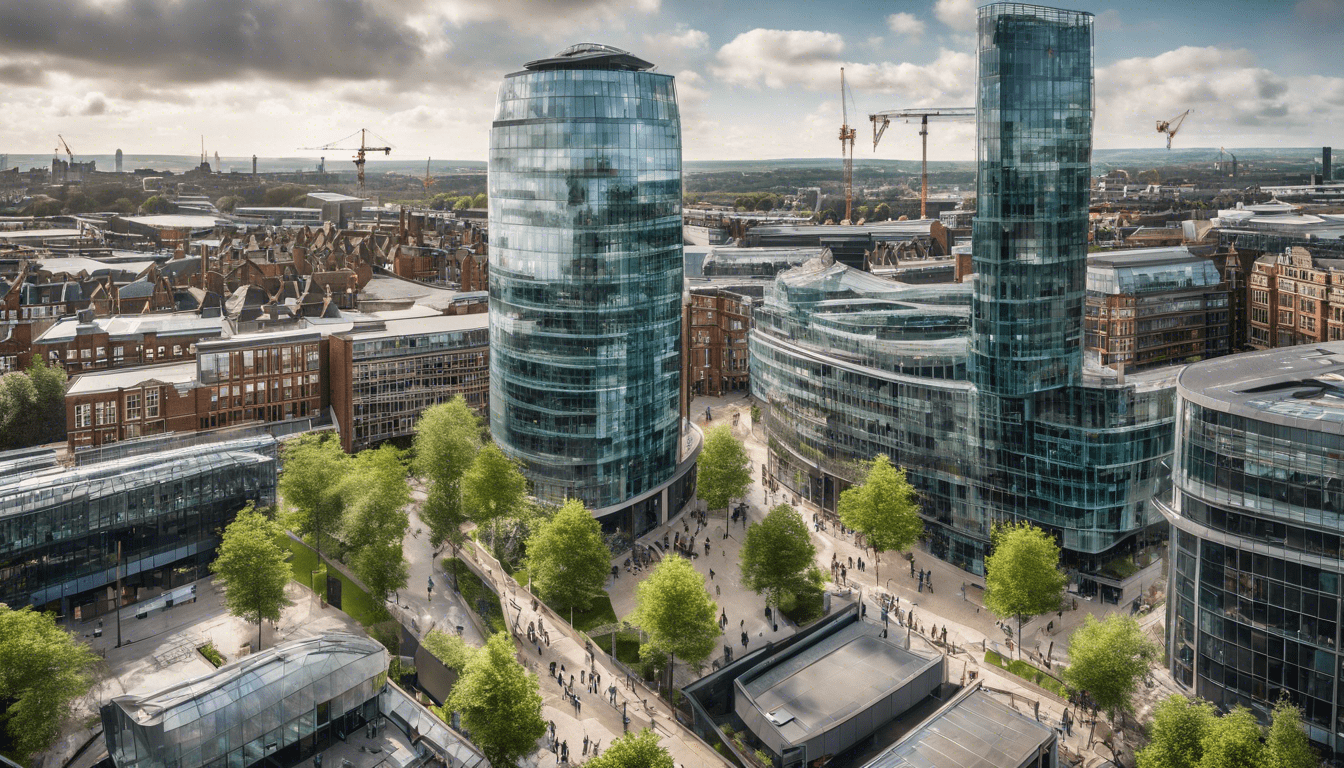

The UK commercial property market is poised for a significant resurgence in 2024, with evidence suggesting a favorable shift in investment dynamics. Analysts predict a revival influenced by anticipated interest rate reductions, a decline in inflation rates, and enhanced options for debt financing. Oliver, the Director of Economics and Research at Colliers, emphasizes that these economic adjustments are pivotal for shaping the market’s future. His leadership in the quarterly Real Estate Investment Forecasts (REIF) report substantiates the optimism surrounding the sector’s recovery.

Moreover, insights from John, the Head of National Capital Markets at Colliers, further illuminate the anticipated growth within various property sectors. With extensive experience in facilitating substantial real estate transactions, John’s expertise suggests that 2024 could herald a new era of investment opportunities. In light of these developments, understanding the factors steering this comeback and the expert predictions will be crucial for stakeholders looking to navigate the evolving landscape of UK commercial real estate.

Key Takeaways

- The UK commercial property market is poised for significant recovery in 2024, fueled by anticipated interest rate cuts and reduced inflation.

- Expert insights from leaders like Oliver and John underscore the optimism regarding investment opportunities in the market.

- The broader recovery in the real estate sector will create favorable conditions for investors looking to engage with emerging opportunities.

Factors Driving the Comeback of the UK Commercial Property Market

As we move into 2024, the UK commercial property market is poised for a notable resurgence, driven by several key factors that include anticipated interest rate cuts, decreasing inflation rates, and improved debt financing options. The insights from Oliver, the Director of Economics and Research at Colliers, further illuminate this trend; he emphasizes the importance of the quarterly Real Estate Investment Forecasts (REIF) report in tracking significant market movements (Colliers, 2024). His extensive background in economic research, supported by positions at prestigious organizations such as the Centre for Economics and Business Research and IHS Markit, provides him with a robust analytical framework to make these predictions. Similarly, John, the Head of National Capital Markets at Colliers, underscores the evolving landscape of real estate finance, particularly through his experience in managing substantial transactions, including the £96 million sale of the SeAH facility in Teesside in 2023 (Colliers, 2024). His team’s expertise spans various property sectors and is dedicated to facilitating equity raising and structured financing solutions for clients, ensuring they are well-positioned to seize emerging opportunities (Colliers, 2024). Collectively, these insights suggest a promising horizon for investors aiming to tap into the revitalizing UK commercial property market.

Expert Insights and Predictions for 2024

According to Oliver, increasing confidence among investors is expected to trigger a wave of investment applications as the UK commercial property sector stabilizes. Coupled with expert predictions of a less volatile economic environment, factors such as rising market liquidity and attractive valuations are likely to encourage both domestic and international investors to re-enter the market. John notes that diversification within investment portfolios could become a central strategy, as various sectors including logistics, residential, and office spaces begin to attract renewed interest. As stability returns, opportunities to acquire under-valued assets may present themselves, allowing savvy investors to capitalize on potential gains. Additionally, the advancements in technology and innovation in finance are streamlining processes in real estate transactions, making it easier for both buyers and sellers to navigate the evolving landscape (Colliers, 2024). This multidimensional growth indicates that 2024 may well be a year of substantial recovery and growth in the UK commercial property market, enhancing long-term investment viability.

Feel free to contact us via WhatsApp, social media, or email.