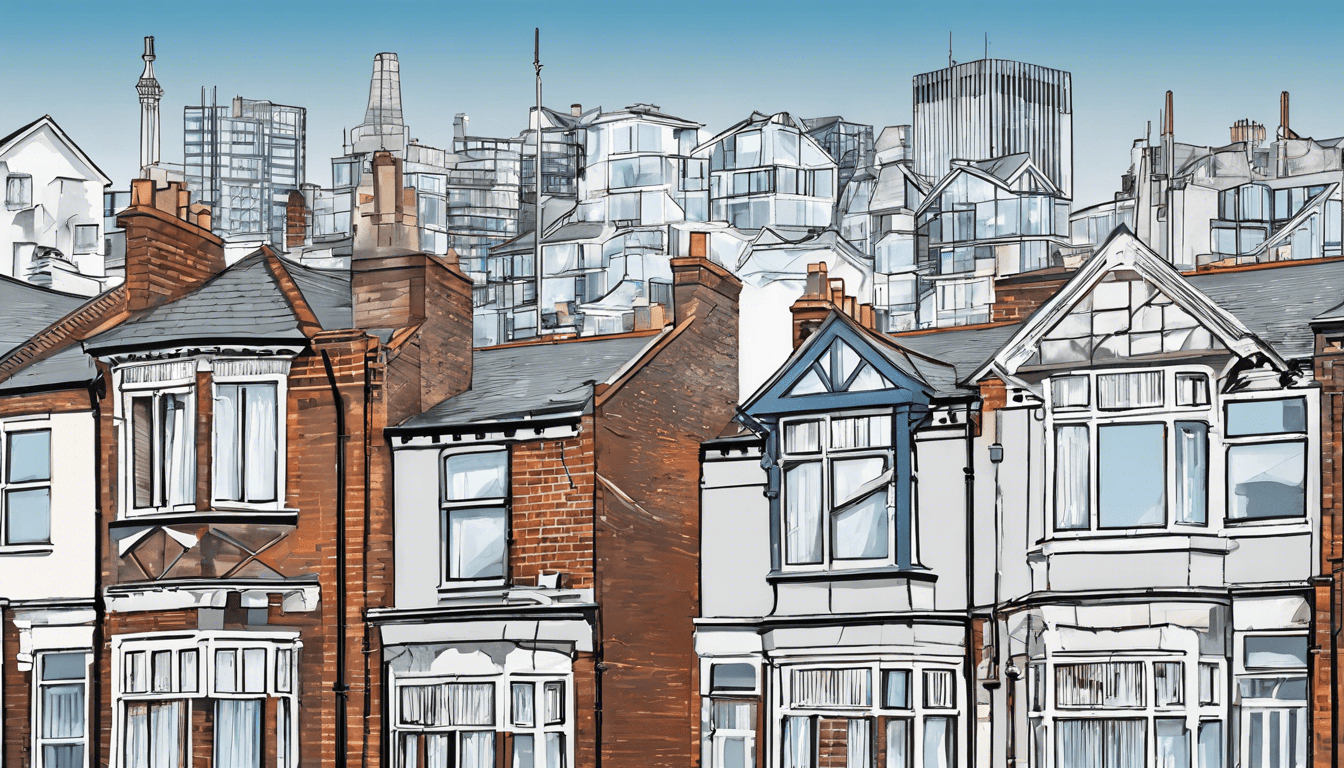

The UK real estate market is preparing for a significant turnaround in 2024, as analysts project a combination of interest rate cuts and falling inflation will catalyze a surge in investment activity, particularly within the commercial property sector. Insights from distinguished experts indicate that the anticipated economic climate may present an attractive landscape for investors. Oliver, who spearheads the quarterly forecasting process for real estate investments, noted that these changes in monetary policy are likely to revitalize growth in property markets across the UK. Meanwhile, John, a leading figure in corporate finance with extensive experience across Europe and Asia, emphasized the importance of innovative capital solutions for navigating upcoming opportunities. As these trends unfold, the real estate sector could be poised for a remarkable boom, making it an opportune time for investors looking to capitalize on evolving market conditions.

Key Takeaways

- Anticipated interest rate cuts in 2024 are expected to stimulate the UK real estate market.

- Experts highlight a significant increase in investment activity in commercial property due to decreased inflation and improved financing options.

- Industry leaders emphasize the importance of strategic capital solutions for unlocking potential in various property sectors.

Expected Impact of Interest Rate Cuts on the Real Estate Market

The UK real estate market is on the cusp of significant transformation in 2024, primarily driven by anticipated interest rate cuts which are set to rejuvenate investor activity. As inflation pressures are expected to ease, financing conditions are likely to improve, subsequently lowering the cost of borrowing for both residential and commercial properties. Insightful analyses from experts such as Oliver, who is at the helm of the quarterly real estate investment forecasting process, and John, noted for his extensive experience in corporate finance across Europe and Asia, indicate that these trends will likely stimulate increased investment in commercial real estate (Smith, 2024). Oliver’s strong academic grounding in economics allows him to adeptly navigate these forecasting challenges, while John’s leadership of a specialized team in property sectors enhances strategic capital allocation for clients seeking optimal deal structures. This convergence of factors suggests a promising outlook for the real estate market in 2024, with the potential for heightened activity and robust investment dynamics.

Investment Opportunities in Commercial Property Through 2024

Additionally, the easing of financial constraints and improving macroeconomic indicators are projected to attract both domestic and international investors. Analysts suggest that as the UK economy stabilizes, sectors such as logistics, healthcare, and technology-focused real estate will become particularly appealing. With rising demand for e-commerce and advancements in healthcare infrastructure, investments in these specialized properties are expected to yield significant returns (Jones, 2024). Furthermore, property funds and real estate investment trusts (REITs) are likely to adapt their strategies to capture emerging opportunities, aligning with market trends. As market conditions evolve, collaboration between investors and financial institutions will be crucial in developing innovative funding solutions, ensuring that stakeholders are well-positioned to capitalize on the anticipated growth in the commercial property sector through

2024.

Please ask us questions via WhatsApp, email, or direct messaging.