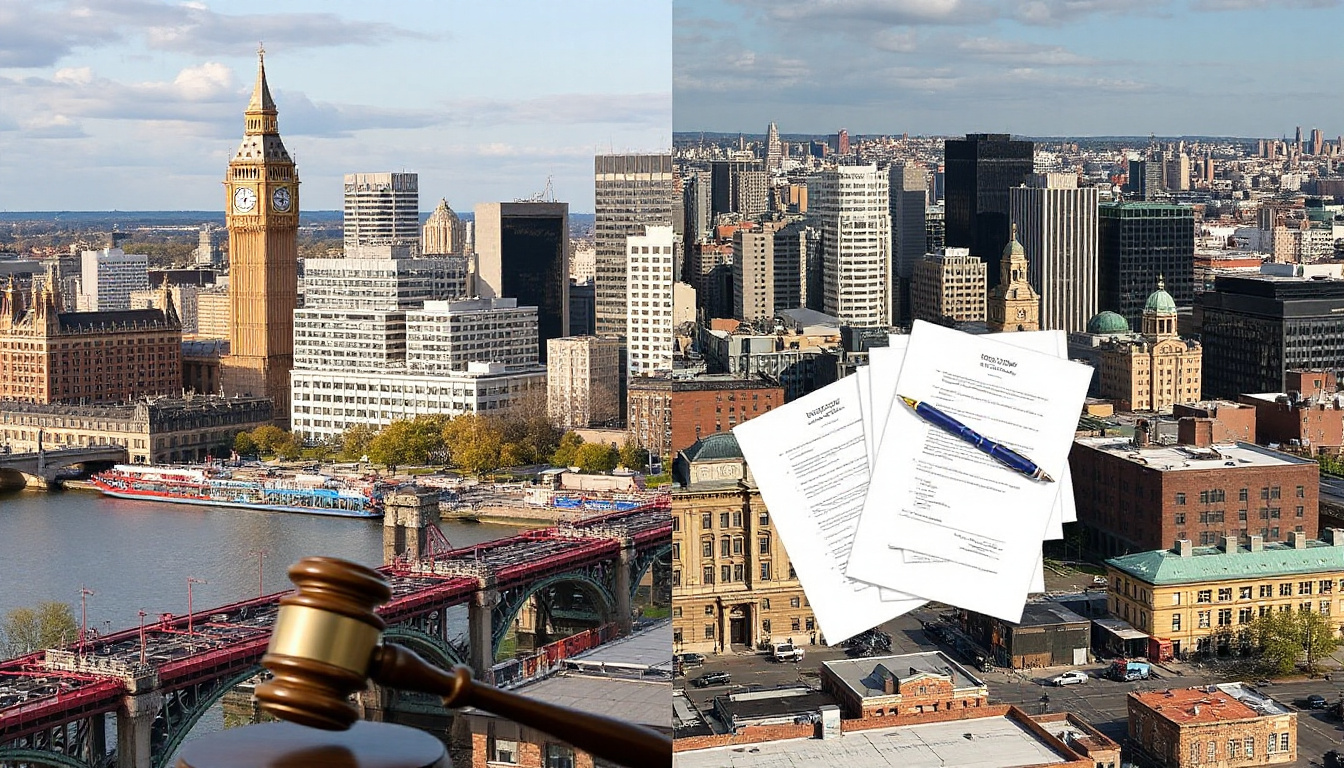

London vs. Detroit: Evaluating Property Investment Opportunities Amid London’s Second Home Clampdown

Property investors face shifting markets in London and Detroit. In London, strict rules on second homes lower the city’s charm. In Detroit, prices stay low and rents stay high. This article compares these markets and gives tips for investment.

London’s Regulatory Landscape: A Shift in Investment Appeal

London once drew many investors from home and abroad. New rules on second homes now shrink London’s appeal.

Recent Policy Changes

The UK government set new rules to fix housing shortage in the city. Stamp duty on second home deals now rises. Ideas to stop non-resident tax breaks came up.

Overseas buyers now pay fees that climb to 17% for second homes. The intent is to use houses as homes, not as profit tools.

Luxury estates in areas like Notting Hill and Kensington stay empty for long. Land costs also grow. In Kensington and Chelsea, the price per square foot sits at £1,498, while the UK average is £343. ## Detroit’s Resurgence: A Beacon for Investors

Detroit’s market grows fast and shows promise for investors.

Affordable Entry Points

Detroit has a median home value near $85,000. The price stays low when compared with London. This fact draws many who want to invest without high start costs.

High Rental Yields

Rents in Detroit bring gains near 7.5%. The rent-to-value ratio stays strong. This makes Detroit a good place to earn rental income.

Appreciation Potential

Home values in Detroit have risen well. From 2014 to 2022, owners gained close to $2.8 billion. This gain marks about an 80% increase.

Government Initiatives

The local government works to fix the city. Officials remove unsafe houses and repair streets. Programs like the Neighbourhood Enterprise Zone cut taxes and help many areas. These steps raise property values and change neighborhood feel.

Comparative Analysis: Weighing the Pros and Cons

A side-by-side look shows clear differences between Detroit and London:

| Factors | Detroit | London |

|---|---|---|

| Entry Price | Low median home value (~$85,000) | High prices, especially in central zones |

| Rental Yield | Strong yields (~7.5%) | Lower yields because of high prices |

| Regulations | Open market conditions | Strict rules on second homes and higher taxes |

| Market Dynamics | Growing market with price gains | Luxury market with many empty homes |

| Economic Factors | City spends on repairs and road work | Stable market with limited growth in some parts |

Strategic Considerations for Investors

The two markets show different traits. London’s old charm falls with strict second-home rules. Detroit brings low costs, strong rentals, and rising values.

Investors must study local houses, neighborhoods, and long-term economy trends. Local experts can give clear advice for each market.

Conclusion

The property scene shifts between London and Detroit. London now tightens rules on second homes, pushing many investors away. Many now see Detroit’s growing market as a smart path for property gains.

For both new and seasoned buyers, a clear look at each market will help find the right choice.

Sources: