In recent years, digital banking has revolutionized the way we manage our finances, appealing particularly to the tech-savvy young professional demographic. Among the numerous options available, two names frequently emerge in discussions about the best digital banking services: Monzo and Revolut. This article will provide a comprehensive comparison of Monzo and Revolut, focusing on their key features and benefits, a cost analysis, and user experience—all to help you determine which digital bank is best suited for your needs as a young professional.

Key Takeaways

- Monzo offers a user-friendly interface with budgeting tools tailored for young professionals.

- Revolut provides a comprehensive suite of features including cryptocurrency trading and international spending benefits.

- Both banks have low fees, but their pricing structures differ significantly based on usage patterns.

- Monzo focuses on a personal banking experience while Revolut positions itself as a global financial platform.

- User experiences vary, with Monzo praised for customer service and Revolut for its extensive functionality.

Overview of Monzo and Revolut

In the contemporary financial landscape, digital banking has revolutionized how young professionals manage their money. Two of the most popular contenders in this space are Monzo and Revolut. Monzo, a UK-based digital bank launched in 2015, has garnered a loyal following due to its user-friendly app and intuitive budgeting features. It allows users to track their spending in real-time, set budgets, and receive instant notifications whenever transactions occur. On the other hand, Revolut, founded in 2015 as well, offers a wider array of services that cater not only to personal banking but also to international travel and cryptocurrencies. With features such as currency exchange without hidden fees and the ability to hold multiple currencies, Revolut has positioned itself as a versatile option for the globally-minded young professional. In this article, we’ll explore the key differences and benefits of Monzo vs. Revolut, helping you determine which digital bank is the best fit for your financial journey.

Key Features and Benefits for Young Professionals

When evaluating digital banking options, young professionals often find themselves debating between two prominent platforms: Monzo vs. Revolut. Understanding the key features and benefits of each can help in making an informed decision tailored to their financial needs. Monzo shines with its user-friendly interface and budgeting tools, which are essential for those just starting to manage their finances independently. Its real-time notifications keep users updated on spending, promoting financial mindfulness. On the other hand, Revolut offers a range of additional benefits, like multi-currency accounts and free international money transfers, making it an attractive option for young professionals who travel frequently or engage in cross-border transactions. Furthermore, Revolut’s cryptocurrency trading feature appeals to tech-savvy users seeking to invest in innovative assets. Ultimately, the choice between Monzo and Revolut will depend on individual financial habits and goals, each offering distinct advantages tailored to the needs of today’s young professionals.

‘In the age of information, the ability to access and manage your finances digitally has become not just an advantage, but a necessity for young professionals navigating their financial futures.’

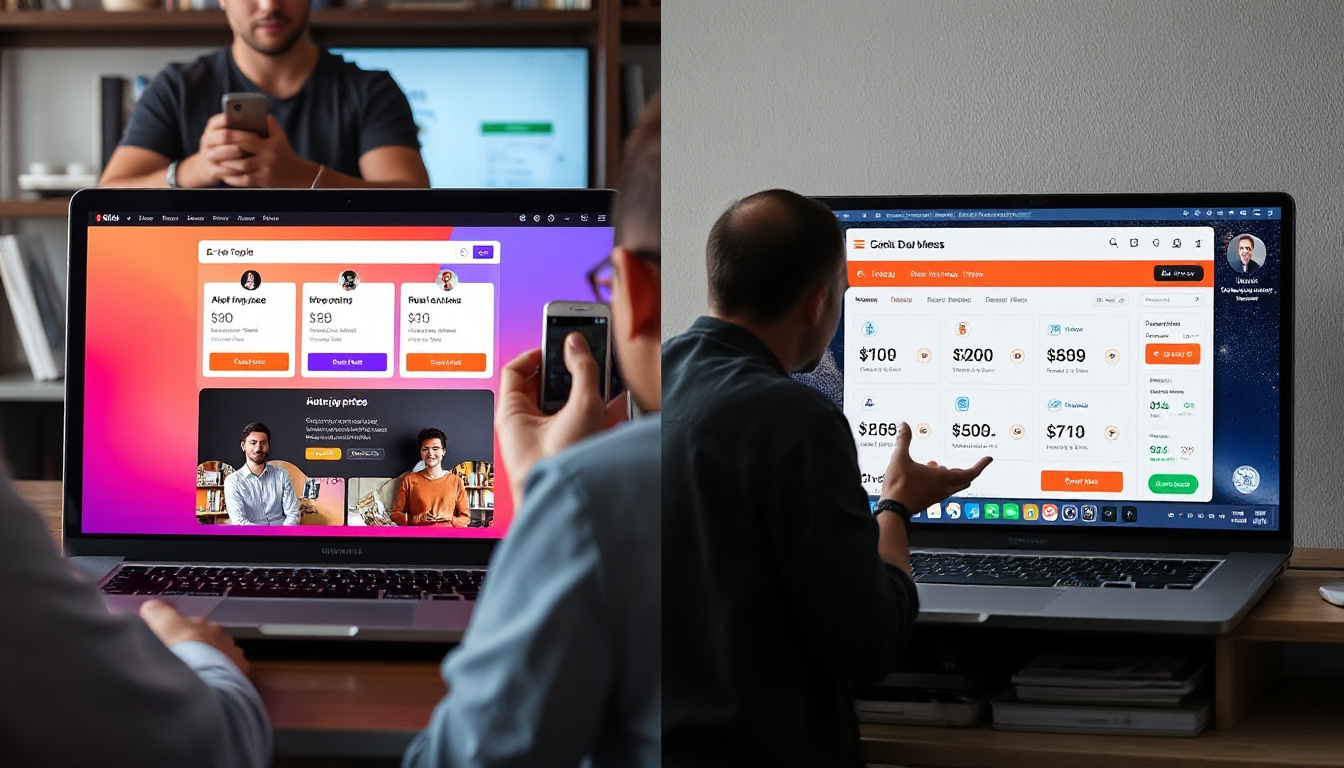

Cost Comparison and User Experience

When it comes to choosing a digital bank, young professionals often weigh their options between Monzo vs. Revolut: which digital bank is best for their needs? Both platforms offer innovative features tailored to a tech-savvy, financially aware audience, but their cost structures and user experiences differ significantly. Monzo operates primarily as a fee-free banking option, charging no monthly maintenance fees, while users can access additional features through its premium accounts at a small monthly cost. On the other hand, Revolut offers a freemium model, providing essential banking services for free but with tiered plans that enable users to unlock advanced benefits like international transfers and crypto trading. In terms of user experience, Monzo’s app is often celebrated for its simplicity and ease of use, featuring budgeting tools that help young professionals manage their monthly expenses effectively. Conversely, Revolut attracts users with its robust range of financial products and intuitive interface, appealing to those seeking comprehensive features in one platform. Ultimately, the choice between Monzo and Revolut will depend on individual financial habits, the importance of international features, and personal preferences regarding app usability.