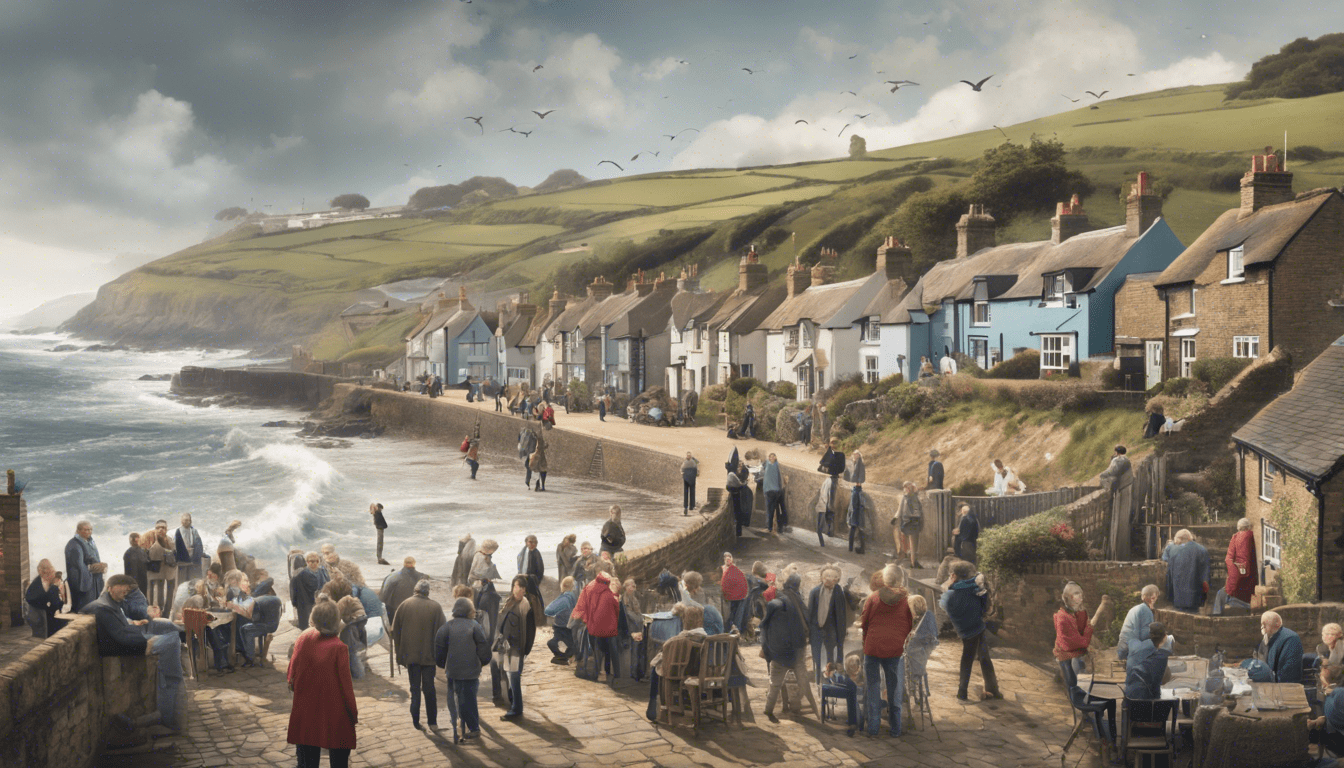

Starting in April 2025, local authorities across England will have the power to significantly raise council tax rates on second homes, a move anticipated to impact housing availability in popular tourist areas. This legislative change follows similar measures that have been in effect in Scotland and Wales, aimed at addressing the growing concern of housing shortages that have been exacerbated by the rise in property purchases for second homes. According to recent statistics, the number of second homes in England increased by 65% from 2010 to 2023, now totaling 482,000 properties (LGA, 2024). These new provisions allow councils to impose a premium on properties that are not classified as a person’s primary residence, with the potential for rates to double, provided owners have received at least a year’s notice. Local councils are already responding, with many in the South West leading the charge to vote for such increases. This could generate much-needed revenue for local economies and help mitigate the effects of funding cuts faced by various councils in recent years.

Key Takeaways

- From April 2025, England will implement significant council tax hikes on second homes to address housing shortages.

- Local councils can charge up to double the standard rate for non-primary residences, following similar measures in Wales and Scotland.

- Homeowners with second properties must stay informed about local tax regulations and potential increases affecting their investments.

Understanding the New Council Tax Legislation

Starting in April 2025, new council tax legislation in England will significantly affect second homeowners, reflecting similar actions already taken in Scotland and Wales. This new framework empowers local authorities to impose council tax premiums on properties not registered as main residences, potentially charging up to double the standard council tax rate. Homeowners will be informed one year in advance of these changes, an approach aimed at alleviating the critical housing shortages faced by local communities in areas popular with second home buyers. Recent statistics indicate a dramatic 65% rise in the number of second homes in England, with figures reaching approximately 482,000 between 2010 and 2023 (Office for National Statistics, 2023). In tandem, several councils in the South West are proactively voting for these taxes, aiming to generate much-needed revenue for local services and infrastructure. Precedents in Wales and Scotland have shown that councils can impose rates up to 300% on second homes, an effective tool that could help address the financial strains many local authorities face due to prolonged budget cuts. Those owning second properties are advised to stay updated by checking their respective local council’s announcements, especially if their property is located in high-demand tourist areas, as the definition of a second home typically encompasses furnished residences not classified as the owner’s primary living space.

Impact on Homeowners and Local Economies

As the new council tax regulations come into force, the implications for local economies and homeowners are multifaceted. The increased taxation on second homes is expected to catalyse a shift in the real estate market, encouraging property owners either to sell or make their homes available for long-term rental, thereby enhancing housing availability for local residents. This initiative is particularly crucial for communities that often face challenges related to housing affordability and availability, especially in tourist hotspots (Smith, 2024). Moreover, the anticipated revenue generated from these premiums can be strategically reinvested into local services like infrastructure and community projects, which have suffered due to past austerity measures. Local councils are tasked with creating frameworks to manage these changes efficiently, ensuring that both residents and second homeowners are adequately supported throughout the transition. Consequently, this policy not only aims to safeguard the housing stock for residents but also provides local authorities with the necessary financial tools to revitalize their economies and improve the quality of life for their constituents.

Feel free to contact us via WhatsApp, social media, or email.

Always find the best rooms to rent & HMOs for sale in the UK at HMO Reporter.